The State of Carbon Markets — 2025 Review

This blogpost synthesizes key findings from five major carbon market reports released in early 2025: MSCI's Carbon Markets Year in Review, the European Commission's report on the functioning of the European carbon market in 2024, the World Bank's State and Trends of Carbon Pricing, ESMA's EU Carbon Markets 2025, and Ecosystem Marketplace's State of the Voluntary Carbon Market 2025.

Together, these reports provide a comprehensive view of both voluntary and compliance carbon markets, revealing critical trends in pricing, supply and demand dynamics, regulatory developments, and market integrity.

1. MSCI Carbon Markets 2025 Year in Review – webinar dia 14/01/26

Supply and Demand: Issuance of new credits fell by 13% to 276 million tonnes due to increased scrutiny and higher costs. However, demand reached record levels, with 202 million tonnes retired, driven by nature restoration projects and non-CO₂ gases.

Corporate Investment: Capital commitments to carbon projects reached USD 16 billion in 2025, led by technology giants such as Microsoft, Google, and Meta, which secured multi-million-tonne stocks of removal credits.

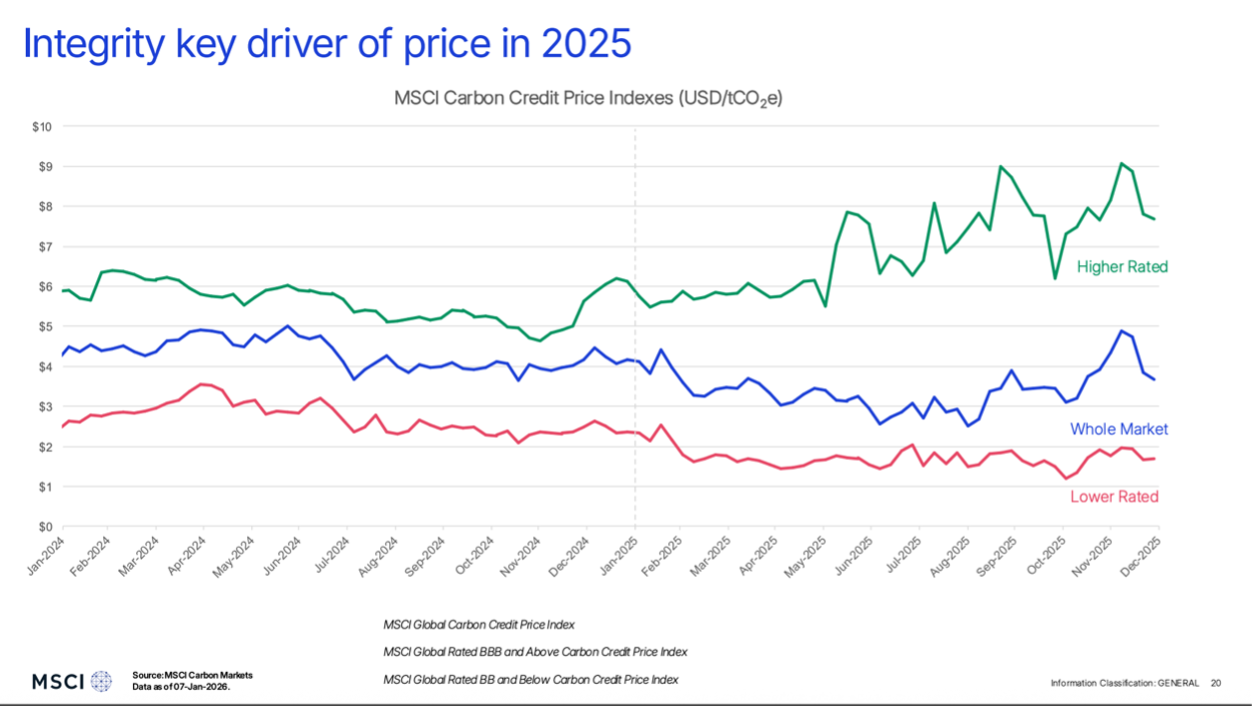

Integrity Premium: Prices for highly rated credits (BBB or higher) rose by more than 20% (average USD 6.80), while low-integrity credits declined. The spread between high- and low-quality credits reached USD 7 per ton.

©MSCI Carbon Markets

Compliance and Article 6: Around one-third of credit demand is now driven by compliance schemes (such as Colombia’s carbon tax). Countries’ readiness for Article 6 of the Paris Agreement tripled in 2025.

©MSCI Carbon Markets

2. European Commission Report on the Functioning of the Carbon Market in 2024

Emissions Reductions: In 2024, emissions from power and industrial installations covered by the system fell by 5.8% compared to 2023. Since the system’s launch in 2005, these emissions have been reduced by 50%.

Revenues and Investment: The system generated €38.8 billion in auction revenues in 2024, which were primarily allocated to Member States’ national budgets for climate action and energy transition.

Scope Expansion: 2024 marked the first year in which maritime transport emissions were included in the system. In addition, preparations for ETS2 (covering buildings and road transport) progressed, with monitoring set to begin in 2025.

Targets: The system remains on track to achieve its target of a 62% emissions reduction by 2030 (compared to 2005).

3. State and Trends of Carbon Pricing 2025 (World Bank)

Record Global Coverage: Direct carbon pricing now covers 28% of global greenhouse gas emissions, a significant increase from 24% in 2024. This growth was driven also due to the expansion of China’s system to the cement, steel, and aluminum sectors.

Stable Revenues: For the second consecutive year, carbon pricing mobilized more than USD 100 billion for public budgets globally.

Market Convergence: There was a threefold increase in credit retirements for domestic compliance purposes in 2024, highlighting the growing role of credits in regulated systems.

New Instruments: There are currently 80 instruments (taxes or ETSs) in operation worldwide, with economies representing two-thirds of global GDP having some form of carbon pricing in place.

4. ESMA Market Report on EU Carbon Markets 2025

Price Dynamics: The annual average price of EU emission allowances (EUAs) fell by 22% in 2024, settling at an average of €65/tCO₂. This decline was driven by weak demand resulting from the continued decarbonization of the power sector and higher auction volumes.

Trading Activity: Despite lower prices, trading activity increased by 35%, reaching a total of 13.7 billion tons of CO₂ equivalent traded across 4.7 million transactions.

Market Participants: The market is dominated by investment firms and credit institutions, which accounted for 63% of total trading volume. Non-financial companies primarily use the market for hedging strategies.

5. Ecosystem Marketplace — State of the Voluntary Carbon Market 2025

Market Contraction: The total value of reported transactions fell by 29% to USD 535 million, with traded volume declining by 25% (84 MtCO₂e). The average price per credit was USD 6.34.

Demand Resilience (Retirements): Although liquidity declined, the volume of credits retired (used by end users) remained stable at around 182 million tons, suggesting consistent demand.

Search for Quality: There is a growing premium for removal credits, which are 381% more expensive than reduction credits, in 2024. Credits from recent vintages (last five years) command a 217% premium compared to older credits.

Integrity Impact: The CCP (Core Carbon Principles) label has begun to influence the market, with approved landfill gas credits seeing an immediate increase in demand and prices.

Conclusion

Carbon markets in 2025 demonstrated a system maturing around quality and compliance. A clear flight to quality is reshaping both voluntary and regulated markets, with high-integrity credits commanding substantial premiums while low-quality assets face declining demand. This scenario reflects heightened scrutiny from corporate buyers and regulators alike.

Compliance markets are expanding and delivering results. The EU ETS achieved a 50% emissions reduction since 2005, while global carbon pricing coverage jumped to 28% of emissions, driven by China's sectoral expansion and new instruments worldwide. The threefold increase in credit retirements for compliance purposes signals growing convergence between voluntary and regulated systems, reinforced by Article 6 readiness tripling during the year.

The voluntary market contracted in transaction value but showed resilience where it matters: credit retirements held steady at ~182 million tons, and corporate commitments reached a record USD 16 billion. This suggests a shift from speculative trading toward strategic, long-term procurement of high-quality credits by serious buyers.

Looking ahead, carbon markets are converging around integrity, transparency, and permanence. With compliance schemes expanding, voluntary standards maturing, and Article 6 gaining traction, 2025 marks an inflection point. The critical challenge is ensuring sufficient high-quality supply to meet growing demand without fragmenting the market's collective goal: cost-effective decarbonization at scale.

Resources:

1. MSCI Carbon Markets 2025 Year in Review – webinar dia 14/01/26 (access valid upon registration)

2. European Commission Report on the Functioning of the Carbon Market in 2024

3. State and Trends of Carbon Pricing 2025 (World Bank)

4. ESMA Market Report on EU Carbon Markets 2025

5. Ecosystem Marketplace — State of the Voluntary Carbon Market 2025